audit vs tax vs consulting

Audit vs Tax Tax vs Audit. Tax accountants have expert understandings of their organizations that enable them to track all important financial information.

Accounting Firm For Tax Audit Advisory Services Windes

Its important to do your research and understand what kind of work is involved in each area internships work.

. All of this is to say the following. Audit usually has the largest headcount then tax and finally advisory. Both tax and audit are rules and research based.

A Big 4 consultant may exit to MBB while a TAS may exit to BB IB. Here are some of the differences between both options. Below is a tabularized representation of the differences between choosing a career in tax vs audit.

Apr 9 2015 - 342pm. I have been mostly interested in audit because of the client interface aspect but I am thinking about applying to a small firm that is hiring for tax accountants. Exposure to a wider range of industry financial reporting.

Bill too many hours and you are breaking the budget and the client is a cheap. Lets dive into the pros and the cons of deciding between tax vs. 02172010 I was wondering what you guys think is the better career path since it looks like Ill be stuck in accounting for a bit.

Has a broader focus than tax. Auditors work with clients from day one where. Where as auditors work in teams.

Moving from audit to TAS isnt easy but isnt like getting into either. Tax professionals must comply with rules set by the Internal Revenue Service and The US. One caveat is that many firms will not hire undergrads directly into their TASFAS groups.

Compared to auditing a consulting career is more open to various backgrounds offers higher salaries and perks 80000year base for consulting vs 50000year for auditing along. Bill too little hours you arent seen as doing your part and your looked at as lazy. An example of scale.

A first-year auditor at Big 4 firms has an average salary of 58000year. Tax accountants typically work individually. I would say if no boutique consulting.

Any suggestions are most. Diversified industry experience to sell. Consulting vs Auditing Salary.

Having pursued my article ship for the past few months and just some knowledge of the subject I might throw into some light on this. Answer 1 of 7. The Big 4 firms pay their consultants over 30 more than auditors.

Tax has a more specialized focus.

Whitley Penn Audit Assurance Tax And Consulting Services

How Does The Hierarchy At The Big Four Pwc Ey Kpmg Deloitte In Their Consultancy Wings Compare To One Another In Terms Of Seniority Quora

Tax Audit Definition Example Explanation And Types Wikiaccounting

How To Choose Between Tax Or Audit Big 4 Accounting Firms Kpmg Deloitte Ey Pwc Youtube

5 Reasons To Choose Tax Over Audit Big 4 Tax Manager Youtube

What Is An Audit The Best Guide On The 3 Types Of Audits Ageras

How To Select The Right Audit Tax Consulting Firm

Finance Vs Consulting Compare Which Career Is Right For You

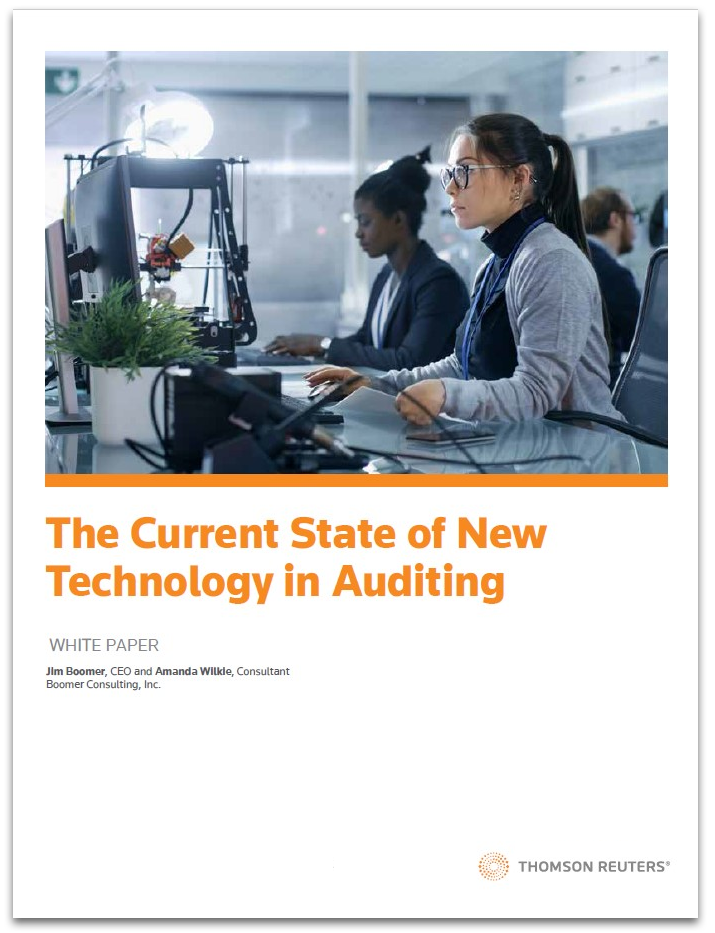

New Technology In Auditing For Tax And Accounting Firms

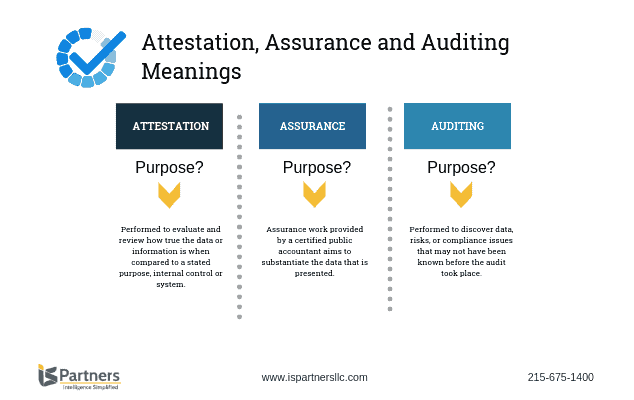

Defining Attestation Auditing Assurance I S Partners Llc

Ppt Audit Vs Tax Powerpoint Presentation Free Download Id 6725761

How To Start An Accounting Audit Firm Or Tax Con By Anuu11 On Deviantart

/terms_a_audit_FINAL-b4a2585d88324882abff73bde31145c9.jpg)

Audit What It Means In Finance And Accounting 3 Main Types

Houston Sales Tax Audit Help State Sales Tax Consulting

Audit Tax Consulting Financial Advisory Services Grant Research And Grant Proposal Writing

Services Deloitte Audit Consulting Financial Advisory Risk And Tax Services

Deloitte Us Audit Consulting Advisory And Tax Services Spiral Notebook For Sale By Stupitshopid Redbubble